Financial Aid Timeline

- Some scholarships have deadlines as early as August. Students should search and apply for scholarships, which may include completing a resume showing their extracurricular activities, a letter of recommendation completed by their counselor or academic teacher, a transcript and an essay.

- Students should complete the CSS/Financial Aid PROFILE. In addition to the FAFSA, many schools require completion of the CSS PROFILE to determine eligibility for non-government financial aid, such as grants, loans, and scholarships.

- The California Dream Act application opens October 1. If your child is undocumented in California, they should apply. Students who reside outside of California should check to see what support your state may provide and contact Immigrants Rising staff directly with questions at immigrantsrising.org/staff

- If you’re a California resident and your child is applying to a school in California, they should create an online account with the California Student Aid Commission and ensure the high school submits a certified GPA to be considered for a Cal Grant Award.

- The Free Application for Federal Student Aid (FAFSA) opens in December. In addition to determining eligibility for federal funds, many colleges and states use the form when distributing grants, so your child should apply right away. A month after submitting, students will receive a Student Aid Report (SAR) that will provide basic information about their financial aid eligibility. Review it carefully and correct any mistakes.

- Fall acceptance letters and financial aid offers will start to arrive. Review acceptances, compare financial aid packages, and visit your child’s final choices, if possible.

- Colleges may require your child to verify your financial records. If your child is selected they will need to send a transcript of your taxes to the college they will be attending. Tax transcripts can be obtained by phone or online through the IRS website. The college will send students an email with a link to submit these forms accordingly.

About Financial Aid

Financial aid is the money that is given to students to help them pay for college. This financial assistance covers educational expenses including tuition and fees, room and board, books and supplies, and transportation. There are several types of financial aid. Financial aid awards may include a combination of the various types of aid.

Types of Aid

Grants and Scholarships

Grants and scholarships are often called “gift aid” because they are free money—financial aid that doesn’t have to be repaid. Grants are often need-based, while scholarships are usually merit-based.

Grants and scholarships can come from the federal government, your state government, the college, or a private or nonprofit organization. Your scholar should apply for any grants or scholarships they might be eligible for.

Federal Loan Programs

Federal student loans are administered by the federal government and offer many benefits that don’t typically accompany private loans. These include fixed interest rates, income-based repayment plans, loan cancellation for certain types of employment, postponement options, and interest rate reduction based on the repayment plan. Federal loans also do not require a credit check.

Federal Work-Study

Federal Work-Study provides part-time jobs for undergraduate and graduate students with financial need, allowing them to earn money to help pay education expenses. The program encourages community service work and work related to the student’s course of study.

Financial Aid Terminology

Free Application for Federal Student Aid (FAFSA)

Every student must submit the FAFSA if they want to apply for federal and state financial aid. Many colleges and universities, especially public institutions, also require the FAFSA. Your student must submit the FAFSA every year that they want aid.

CSS Profile

In addition to the FAFSA, some colleges and universities will want your student to complete the CSS Profile as part of their financial aid process for aid like grants and scholarships. The schools that require completing the CSS profile are listed on the CSS Profile website.

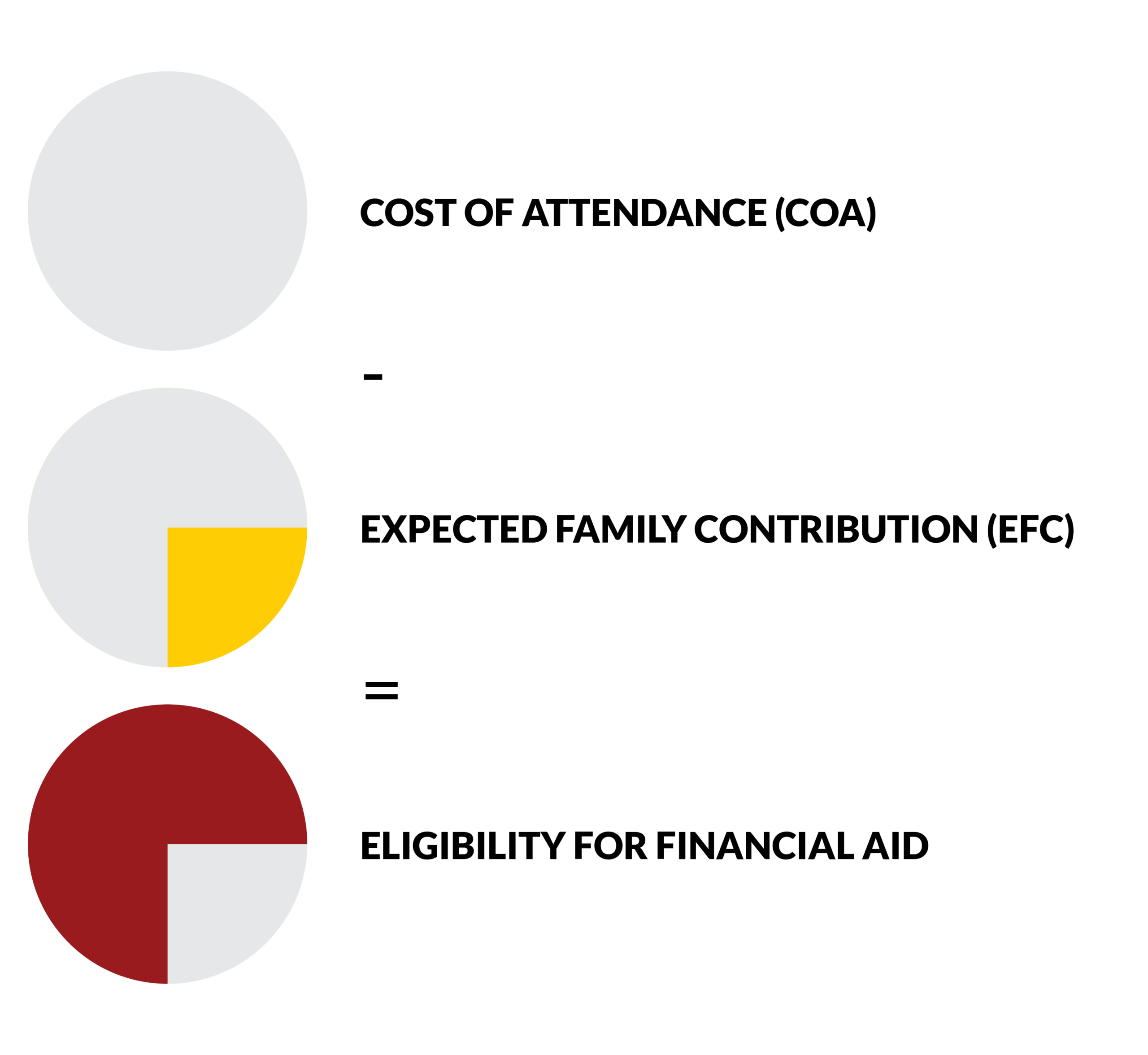

Cost of Attendance (COA)

Includes tuition and fees, housing, meals, books and supplies, transportation, and personal expenses.

Expected Family Contribution (EFC)

An estimate of the total amount that a family is expected to pay per year for their child to attend college. The EFC is calculated using the financial information provided in the Free Application for Federal Student Aid (FAFSA).

A student’s eligibility for financial aid is determined when EFC is subtracted from the COA of any school to which the student applies.

Big Ticket Scholarships and Scholarship Search Tools

Questbridge

Questbridge provides winners with a full four-year scholarship covering tuition and fees, room and board, books and supplies, transportation, and personal expenses.

Gates Scholarship

Gates Scholars are awarded the full cost of attendance that is not already covered by other forms of financial aid as determined by the FAFSA application.

Jack Kent Cooke Foundation

Cooke College Scholarship Program awards winners Up to $40,000 per year to attend a four-year accredited undergraduate school, personal advising about selecting a college and navigating financial aid, and multifaceted advising about how to transition to college and maximize the student experience.

Hispanic Scholarship Fund (HSF)

HSF funds are based on merit; with amounts ranging from $500 to $5,000 based on need, among the scholars selected.

Cameron Impact Scholarship-Bryan Cameron Education Foundation

The Bryan Cameron Foundation awards 10-15 high school seniors for four-years, including (tuition, fees, course-related expenses, books, supplies, and equipment). Total award is estimated between $20,000 – $50,000 per year.

The Posse Foundation

Each Posse Scholar wins a four-year, full-tuition scholarship to attend at one of their partner colleges and universities.

Edison STEM College Scholarship

Edison International awards $40,000 college scholarships to 30 high school seniors to help them follow their dreams in science, technology, engineering or math (STEM) in college.

USC Scholarships

Ranging in value from a few thousand dollars up to full tuition, USC merit scholarships are awarded based on academic excellence, leadership, service, and talent. These include the full-tuition, four-year Mork Family, Stamps and Trustee scholarships, the half-tuition Presidential Scholarship, and the one-quarter tuition Deans Scholarship. All students who submit a complete application by December 1 will be automatically considered for a scholarship.

Scholarship Search Tools

Your child can create a free profile and get matched to scholarships and grants that they qualify for from colleges, universities, organizations, foundations, corporations, government and more. These sites can search thousands of scholarships and grants to find those for which your child is eligible. Some scholarship-search sites will also allow you to create a parent account, so you can join in on the scholarship search.

Federal Student Grant Programs

The federal government provides grant funds for students attending colleges, career schools, and universities. Grants, unlike loans, are sources of free money and do not have to be repaid. The major federal student grant programs are briefly described below:

Federal Pell Grant

- Awarded to undergraduate students who have exceptional financial need and who have not earned a bachelor’s, graduate, or professional degree; in some cases, students enrolled in a post-baccalaureate teacher certification program may receive a Federal Pell Grant

- A student who meets certain requirements might be eligible for a larger Pell Grant if his or her parent died as a result of military service in Iraq or Afghanistan or in the line of duty as a public safety officer

- Pell Grant lifetime eligibility is limited to 12 semesters or the equivalent

Annual Award (subject to change)

Up to $6,895 a year (based on 2022-2023 award year)

Federal Supplemental Educational Opportunity Grant (FSEOG)

- Awarded to undergraduate students who have exceptional financial need

- Federal Pell Grant recipients receive priority

- Not all schools participate in this program

- Funds depend on availability at the school

Annual Award (subject to change)

Up to $4,000 a year (based on 2022-2023 award year)

How can my student receive a federal grant?

Almost all grants are awarded to students with financial need. To apply, the student will have to submit a Free Application for Federal Student Aid (FAFSA) form. They will have to fill out the FAFSA form every year to stay eligible for federal student aid. Once completed, the student will communicate with the college to find out how much aid they will receive and when they will receive it.

Adapted from www.studentaid.ed.gov

Federal Student Loan Programs

The U.S. Department of Education’s federal student loan program is the William D. Ford Federal Direct Loan (Direct Loan) Program. Under this program, The U.S. Department of Education is the lender.

Direct Subsidized Loans

Loans made to eligible undergraduate students who demonstrate financial need to help cover the costs of higher education.

Direct Unsubsidized Loans

Loans made to eligible undergraduate, graduate, and professional students, but eligibility is not based on financial need.

Direct PLUS Loans

Loans made to graduate or professional students and parents of dependent undergraduate students to help pay for education expenses not covered by other financial aid. Eligibility is not based on financial need, but a credit check is required. Borrowers who have an adverse credit history must meet additional requirements to qualify.

Why should your student take out federal student loans?

Federal loans are an investment in their future. You should not be afraid of your child taking out federal student loans if it is necessary for covering a small portion of the costs of attending college.

- The interest rate on federal student loans is usually lower than that on private loans.

- The government pays the interest on the Direct Subsidized Loan while your child is in school.

- Federal student loans offer flexible repayment plans. Students do not begin repaying their student loans until after they leave college.

- If the student works in certain jobs, they may be eligible to have a portion of their federal student loans forgiven.